Randle’s Ramblings #6

The Mirage of Safe Assets

TL;DR: When narratives wobble, investors rush to gold, bills, money funds, and stablecoins. That rush feels prudent, yet safety is a moving target. Yields compress into the crowd, wrappers add hidden frictions, and collateral chains kink under stress. The smart move is to rent safety with structure, avoid overpaying for wrappers, and pre define the triggers to rotate back into risk.

The setup: stories move first, then flows, then prices

In RR #4 we framed liquidity and cycles. In RR #5 we showed coordination at work, policy on one side and investor positioning on the other. This week we add a harder truth. Safety is a story as much as it is a balance sheet. When leaders cool the narrative, capital runs to the rails with the fewest frictions. The inflow is swift, the comfort immediate, the costs delayed.

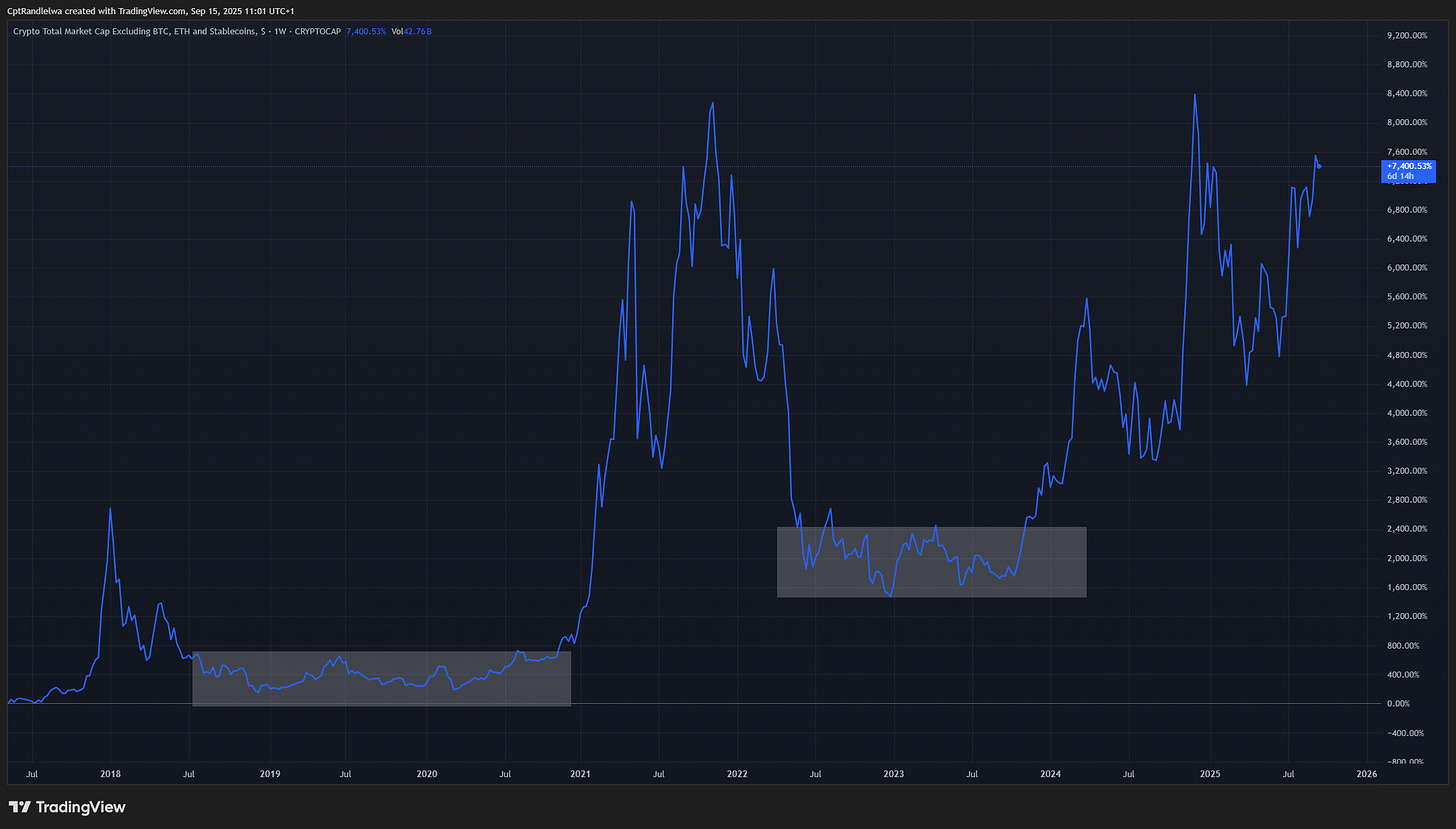

Gold breaks to highs while cut odds rise. Money funds set new peaks as cash parks. Bills look like a free lunch until the policy lane tilts and real cash compresses. Stablecoins earn a spread on T-bills, then incentives shift when rates fall. Bond ETFs promise intraday liquidity, then trade at a discount on stress days while the underlying remains sound. None of this is new. All of it is timely.

Safety is not an asset class. Safety is a state that depends on liquidity, haircut, governance, and belief. You cannot buy that state outright. You can only rent it, and you must know when to give it back!

What counts as ‘safe’ today, and why it changes

Pristine collateral: T-bills and on-the-run Treasuries clear fast, price tight, and carry minimal haircut. They are the core of institutional safety.

Policy convexity hedges: Gold behaves like insurance against policy error. It does not need inflation to rise. It needs a path where central banks err on the side of ease or geopolitical risk persists.

Cash wrappers: Money market funds and short-duration ETFs provide access to the same collateral, with wrapper frictions that show up only when gates or settlement rules tighten.

Digital cash: Stablecoins give programmatic settlement and global reach, plus an economic link to T-bill yields. They work best when governance is clear and banking partners are stable.

Operational rails: Custody, reporting, and compliance transform an asset into usable collateral for institutions. Rails make assets safe to use, not just safe to hold.

Safety sits at the intersection of these, not inside any single bucket.

The macro table: slower pass-through, cooler labor, easier policy

Two things matter for the safety bid this month.

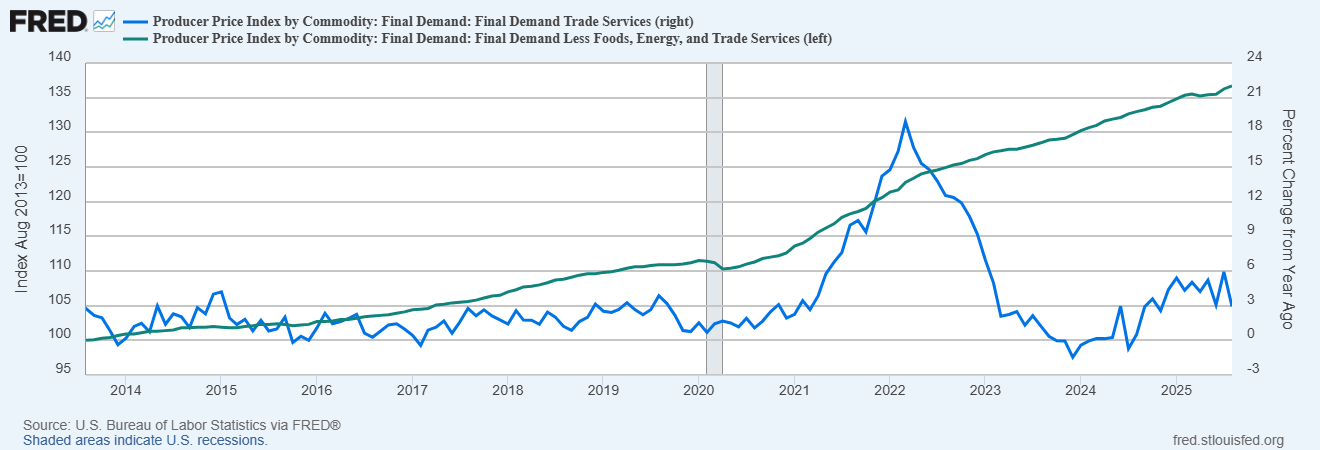

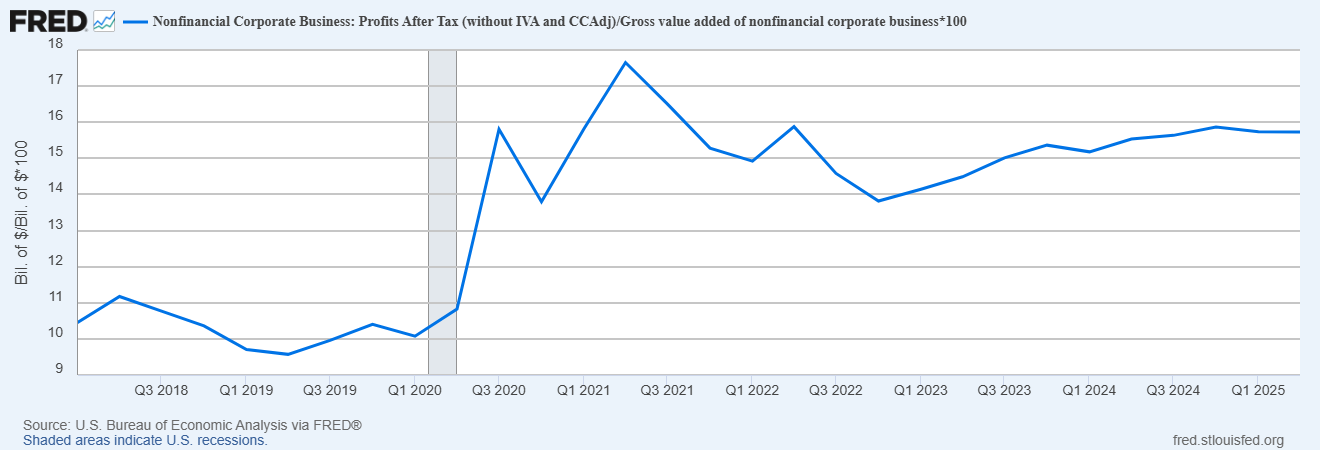

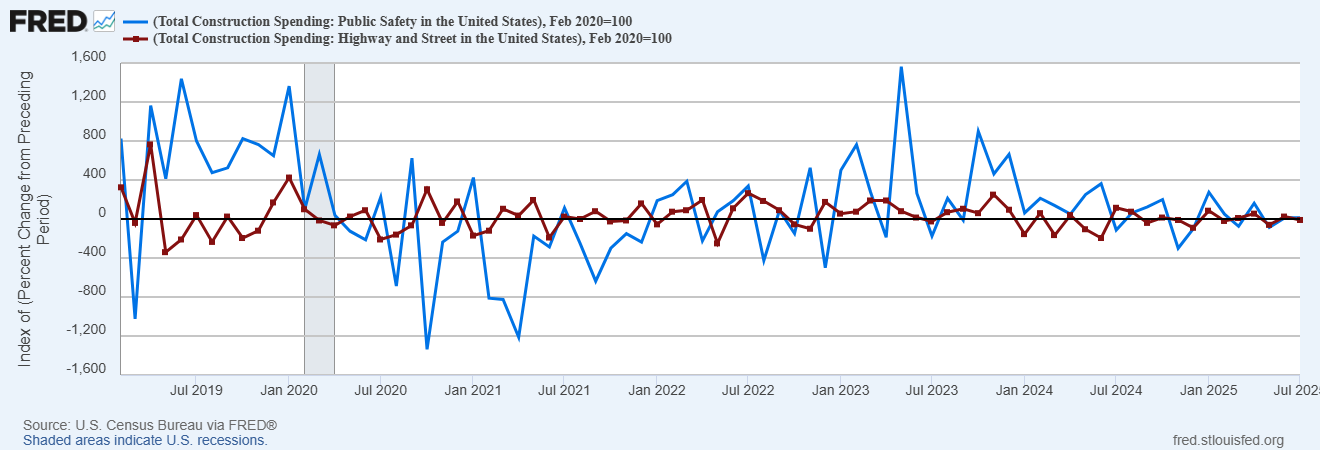

Tariff pass-through is slow and uneven. Intermediate input prices lift first, retail and wholesale margins compress down the chain. That slows the consumer-level impulse while squeezing earnings at the last mile. Headline inflation looks contained in the near term, yet underlying pressure remains. This is the cocktail that attracts flows to ‘safe’ rails while equity analysts debate margin durability.

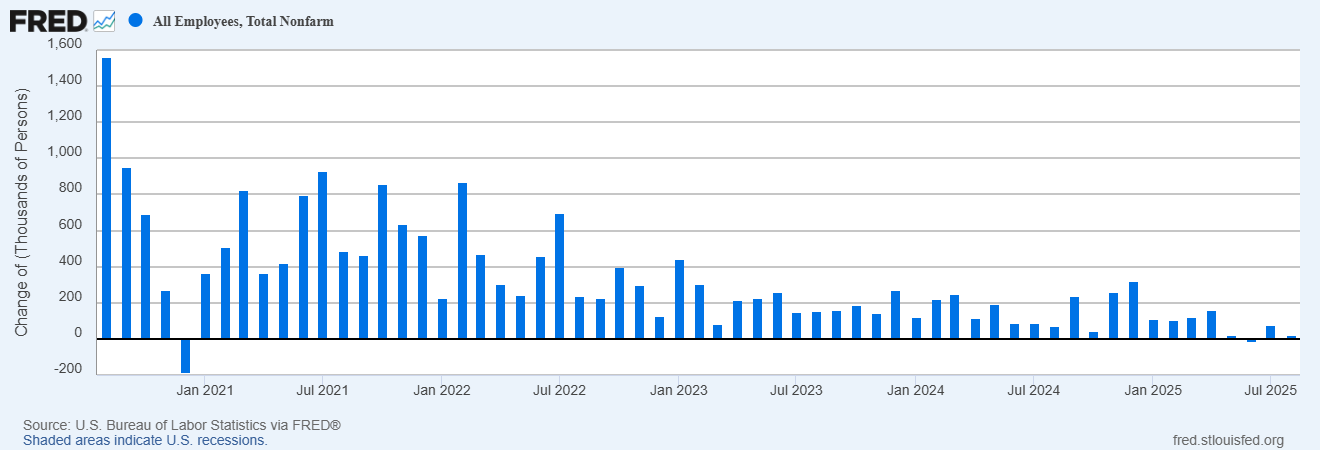

Labour revisions confirm a cooldown, not a break. The latest benchmark revision knocks job gains lower over the past year. The effective breakeven to keep unemployment steady sits much closer to ~75k per month than the pre-2020 rule of thumb. Openings and quits have retraced toward 2019 levels. Claims remain range bound. Cooling labour with steady unemployment invites gentle policy, and gentle policy invites a safety bid.

Put the pieces together. Margins are thinner downstream. Labour is cooler without cracking. Policy leans easier. The first stop for capital is the safety lane, not because catastrophe looms, but because the spread between perceived risk and realized risk is wide enough to monetise.

The cost of safety: yield, wrapper, and liquidity illusions

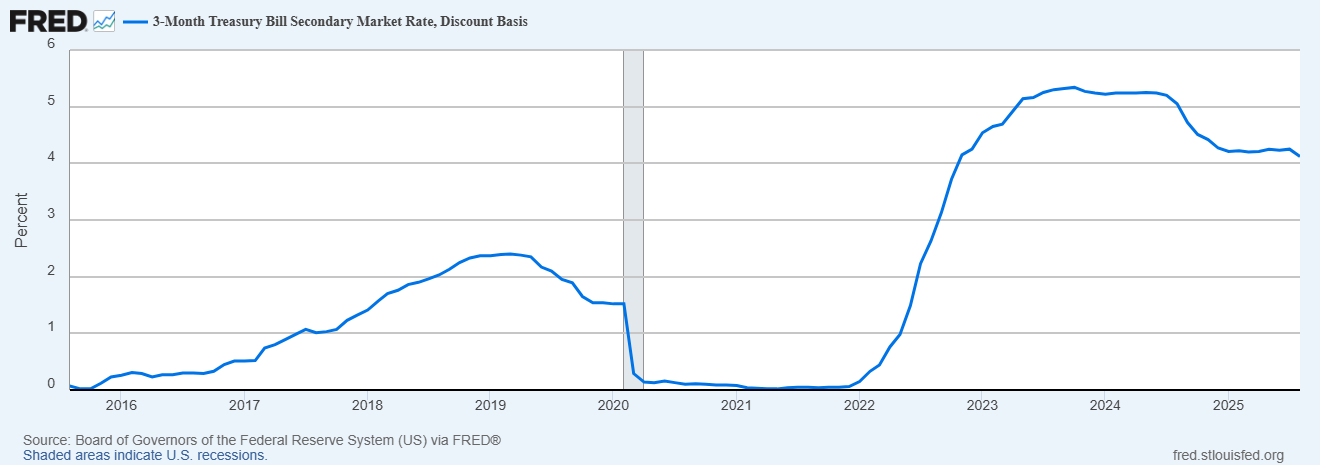

Yield compression. When cut expectations firm, bill yields compress. Money fund yields lag lower, then settle below investor memory. The carry that felt generous last month becomes ordinary next month. If your plan relies on today’s carry lasting, you are paying tomorrow’s fee today.

Wrapper frictions. Funds that promise daily liquidity can use gates in stress. Bond ETFs can trade at discounts when APs step back and secondary market liquidity does the heavy lifting. Nothing is broken, the wrapper is doing its job. The illusion is thinking wrapper liquidity equals underlying liquidity at all times.

Liquidity illusions. Spreads look tight and depth looks ample until a few large holders rebalance. Safety vehicles concentrate flows, which concentrates the unwind. If you must exit with the crowd, you will pay the crowd’s price.

The move is not to avoid wrappers or bills. The move is to know what you own, size the bet as a rental, and plan your exit while spreads are forgiving.

Gold: treat it as policy convexity, express it with structure

Gold’s most durable rallies coincide with easier policy paths, reserve diversification, and geopolitical noise. It is not only an inflation hedge. It is a policy convexity hedge. When the lane bends toward ease, gold picks up the slack without needing CPI to scream.

How to own it without chasing:

• Staged entries on two to three percent pullbacks toward the prior breakout level.

• Three month call flies centered four to six percent above spot, financed with the wings, so you rent upside while capping theta.

• Respect weekly RSI and avoid adding after vertical weeks.

Bills and money funds: a cash-plus ladder that behaves

Bills are the backbone of institutional safety. They are also the most crowded trade at the end of a tightening cycle. The answer is simple structure.

A cash-plus ladder:

• 40 percent in 1–3 month bills, 40 percent in 3–6 month bills, 20 percent in ultrashort IG with tight duration controls.

• Roll monthly, reinvest coupons, and keep the average maturity short enough that cuts do not erase your real carry overnight.

• Do not reach for yield with duration. Reach with structure and discipline.

Digital cash: stablecoins and the rails that make them safe to use

As rates fall, reserve income on stablecoins fades, incentives and fee schedules can change, and spreads compress. That is fine. The value of digital cash is settlement and reach, not a forever yield.

How to own and operate it well:

• Diversify issuers and chains, keep custody safeguards, reconcile balances with bank statements regularly.

• Treat promotional yields as marketing. The structural return comes from speed and reduced working capital friction, not a teaser APY.

• For institutions, integrate stablecoins into a compliant workflow so cash can move between ETF custodians, Prime brokers, and on-chain venues without manual bottlenecks.

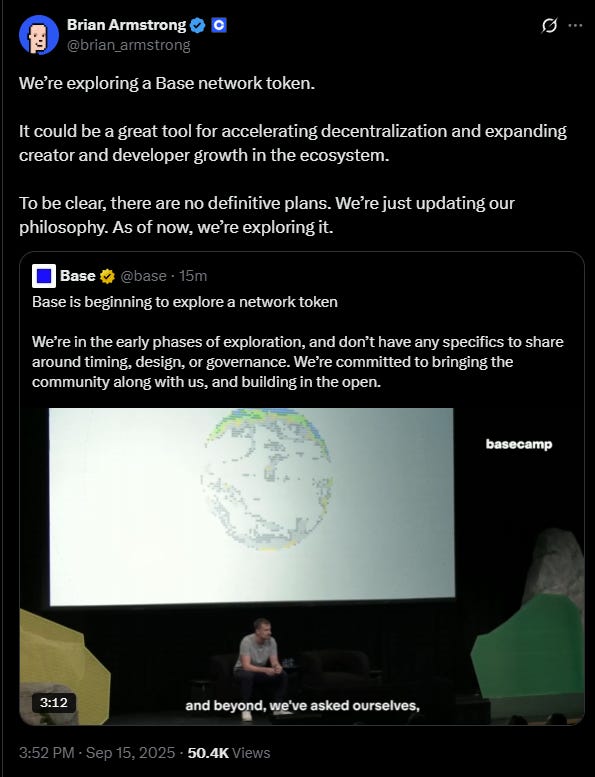

Coinbase as the bridge. This is where operational safety matters. Coinbase sits across custody for US spot ETFs, Prime for execution and financing, Base as a low-cost settlement lane, and USDC at global scale. When allocators start inside wrappers, they graduate to custody and Prime, then settle more on chain. The bridge that institutions already trust captures the flywheel. That is operational safety, not just asset safety. While we’re on the subject of Coinbase, some breaking news:

The wrappers are not the assets

Wrappers unlock distribution and convenience. They do not remove basis risk, nor do they guarantee best execution in stress. The wrapper is the front door. The plumbing behind the door determines how the house behaves when everyone leaves at once.

Investor checklist for wrappers:

• What is the creation–redemption mechanism.

• Who are the APs and how concentrated are they.

• What is the settlement calendar and holiday schedule.

• What is the plain-English policy for gates and fees.

• What are the audit and custody arrangements, and who sits where.

It is attractive to outsource all this to a brand. Resist that impulse. Read the documents. If you cannot, size the position as rented exposure and assume the exit will cost a few basis points more than you modeled.

Positions that fake safety

Crowded defensives that quietly carry duration.

Quality screens that overweight long duration cash flows when rates fall, then underperform when cyclicals revive.

Bond ETFs used as cash when the underlying liquidity does not match the headline AUM.

Diagnosis is simple. Run factor look-through on anything you call safe. If the sensitivity to rates or spreads is large, you do not own cash. You own a view in a cash wrapper.

A practical playbook

1) Rent safety. Do not marry it.

Three month horizons, rolling ladders, defined options structures. No open-ended promises to yourself.

2) Define rotation back, now.

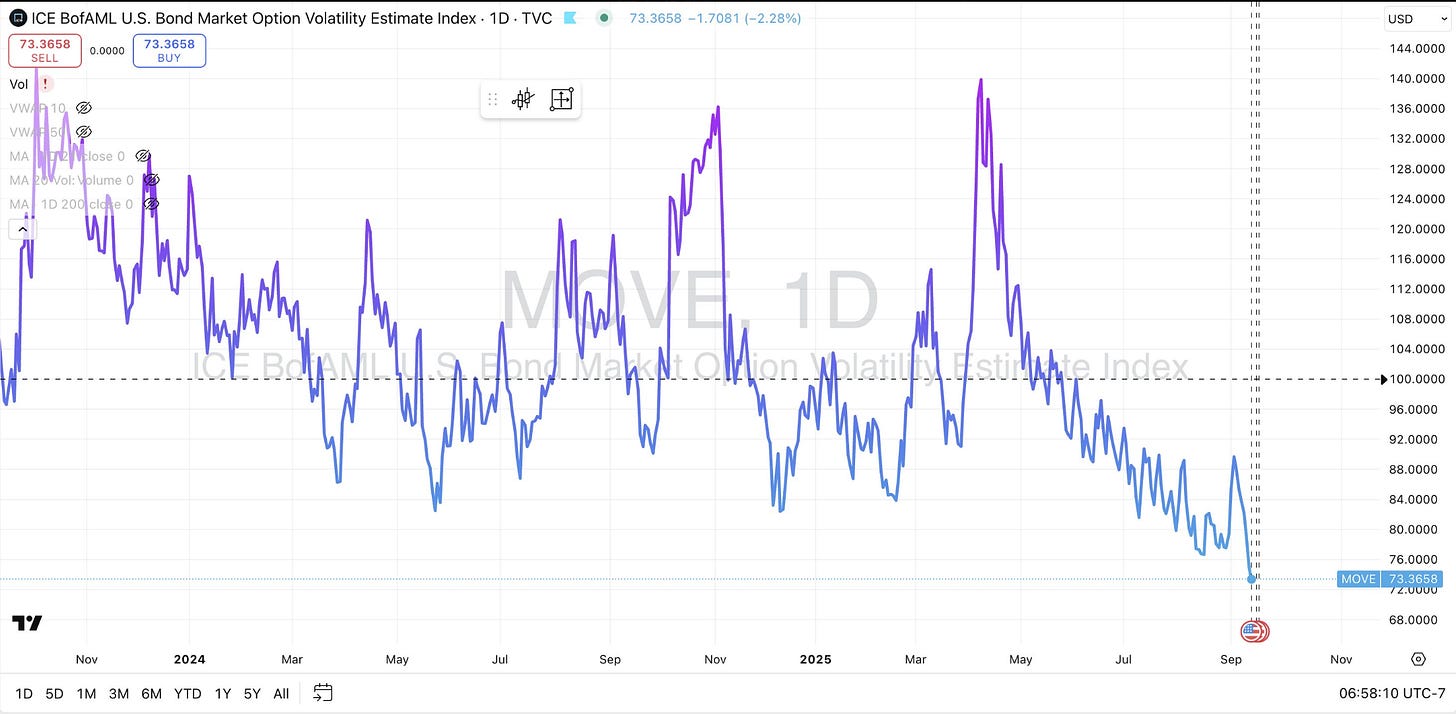

Re risk when cut odds stabilise, cyclicals beat, and breadth improves. Re risk when the leaders you treat as proxies reclaim their trend lines. Re risk when liquidity measures like MOVE ease without equity weakness.

3) Separate asset safety from operational safety.

A T-bill in theory is a T-bill. A T-bill inside the wrong wrapper, at the wrong size, at the wrong time, is something else. Rails matter.

4) Keep insurance that pays when you are wrong.

Gold via call flies. Limited-risk equity hedges around event clusters. Small, not heroic.

5) Measure crowding with flows, not vibes.

Money funds at highs, ETF inflows, and stablecoin plateaus are your tells. Price confirms, flows lead.

The investor checklist, taped to the monitor

Policy: Cut odds, 3 day average.

Rates: MOVE index, 2s–10s slope, DXY.

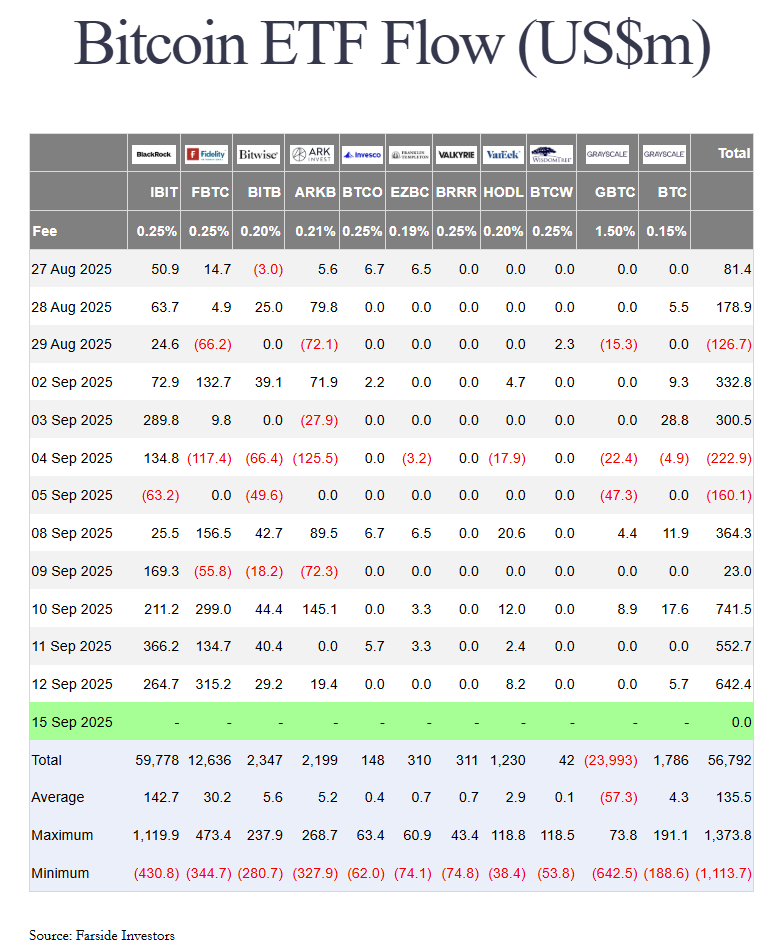

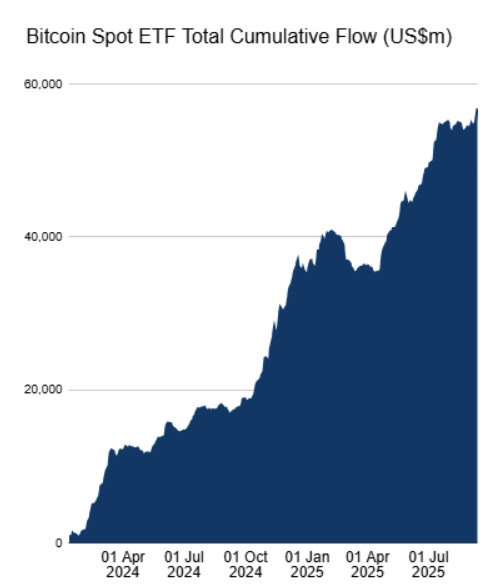

Flows: BTC and ETH spot ETF net flows and 5 day sums.

Breadth: RSP/SPY and IWM/SPY trend lines.

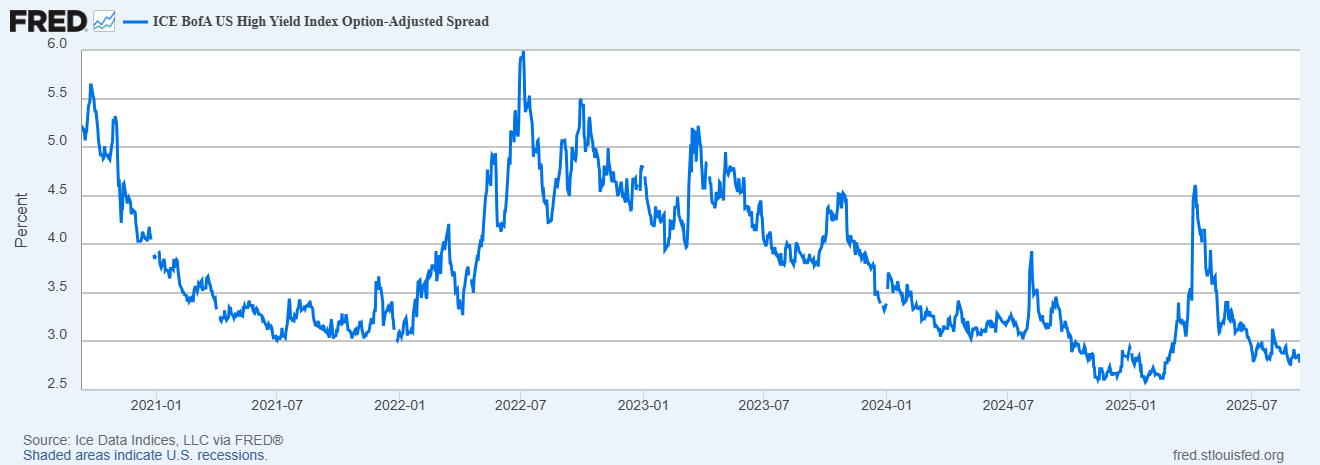

Credit: HY OAS and new issue windows.

Gold: Weekly close relative to breakout, RSI context.

Wrappers: Any visible premium or discount on bond ETFs on stress days.

Rails: Custody and settlement incidents, even small ones.

Where we are positioned for this phase

Core: Cash-plus ladder in bills, small ultrashort IG sleeve, staged gold exposure via call flies or pullback adds.

Satellite: Select capex receivers with power and storage leverage rather than headline chips.

Tactical: We will only deploy the Long BTC vs Short AI basket (RR #5) when three conditions align:

NVDA/SPX closes below the 20 day EMA for two days.

BTC spot ETF 5 day net flow sum is positive.

Cut odds are stable to rising over three sessions.

Until then, patience. Safety is rented.

Supporting sections

Macro data and context

Tariff pass-through:

Labor market:

Productivity and margins:

Credit and liquidity:

Markets: breadth, rotation, and where safety meets risk

Breadth: RSP/SPY and IWM/SPY have improved from their summer troughs. That is not a guarantee of a new leadership regime. It is a sign that the safety crowd and the laggard bid can coexist. The rotation will not be a bell, it will be a grind.

Sentiment: AAII shows a heavy bear tilt even as SPX prints highs. Schwab’s STAX improved but lives near a multi-year low range. Positioning is cautious at the edges. That is supportive for “rent safety, plan re-risk.”

Setups

• Gold: staged adds or call flies.

• Cash-plus ladder: roll monthly.

• Pair trade discipline: wait for the trigger, do not front run it.

• Small-cap beta: add on IWM/SPY trend continuation with HY issuance healthy and MOVE drifting lower.

Digital assets and rails

The wrapper funnel: Spot ETFs deepen the pie, not shrink it. Institutions enter through wrappers, then move upstream into custody and Prime, then downstream into on chain settlement. Coinbase captures this funnel across ETF custody, Prime workflow, Base throughput, and USDC economics.

Flows over headlines: Use ETF daily flows and the 5 day rolling sums as your primary tape, then price as confirmation. Keep the ETHBTC trend as the rotation tell. Lane is BTC until ETH ETF flows turn positive for several days and ETHBTC reclaims trend.

Operational safety checklist

• Counterparty due diligence, SOC reports, and reconciliations.

• Chain diversification for settlement and bridge risk.

• Incident playbooks and signing policies.

AI and capex: where the “safe” bid meets growth rails

Energy first, compute second. Data centers require power and storage before they require more GPUs. That is why batteries, grid interconnects, and siting are the chokepoints. It is also why energy storage margins matter more than headline unit numbers.

Concentration risk and digestion. Multi-year backlog headlines are impressive. They also concentrate index risk in a handful of names, while suppliers with power leverage compound quietly. We will devote RR #7 and some of RR #8 to this in depth. For RR #6, remember the principle. Safety and growth are not enemies. Safety buys you time to select better growth.

Trading and options setups

Gold call fly example

• Structure: 1 x at-the-money call, sell 2 x calls at +4 to +6 percent, buy 1 x call at +8 to +10 percent, three month tenor.

• Intent: rent convexity into policy ease while capping theta.

Cash-plus ladder

• 1–6 month bills, rolled monthly, 20 percent ultrashort IG sleeve.

• Stop: reduce sleeve if MOVE spikes or HY issuance stalls.

Pair trade template, when active

• Entry: only after NVDA/SPX two daily closes below 20 day EMA and BTC ETF 5 day sum positive.

• Sizing: ATR percent on each leg, set the combined 2 sigma loss to under 75 bps of equity.

• Scaling: take one third at +3 percent, one third at +5–6 percent relative.

• Stop: hard stop at −2 percent relative.

Risk events

• FOMC window, jobs, CPI and PPI clusters, large option expiries, buyback blackout cadence.

Recommendations this week

Book: Against the Gods, Peter L. Bernstein. Risk illusions, why safety is contextual.

Essay: The Safe Asset Shortage, Caballero, Farhi, Gourinchas. The premium on pristine collateral.

Report: BIS Quarterly Review on funds and ETFs in stress. Creation–redemption mechanics that matter when wrappers carry the load.

Podcast: Michael Mauboussin Master Class on expectations, capital cycles, and decision making. Mental models for safety and crowding.

Video: World Gold Council, “Why Gold.” Frames gold as policy convexity, not only inflation hedge.

Closing thought

Safety is a rental agreement with markets. You pay a premium to feel calm while stories cool. The moment to renew is not when the crowd begs for it. The moment to renew is when your checklist says policy still eases, flows still confirm, and wrappers still function smoothly. The moment to leave is when breadth improves, cyclicals beat, your proxies reclaim trend, and carry compresses below your hurdle.

There is nothing soft about this approach. It is hard to rent comfort and give it back. It is harder still to admit that safety is a state that you can only borrow. The reward for doing it well is simple. You keep your options open when others lock theirs.

Cheers,

Ian

Disclosures: I hold COIN 0.00%↑ (Coinbase) and gold.

Ian Randle is a Core Contributor at Derive.xyz and Founder of SettledHere.com