The vision of bringing the world’s assets onchain is compelling: faster settlement, lower costs, global reach, and programmable features that legacy infrastructure cannot match. Yet while the technology has matured rapidly, institutions remain cautious. For most, the barriers are not about blockchains being slow or insecure, they are about regulation, trust, and governance.

This is where the regulatory maze begins. It is not one obstacle, but an interlocking web of legal definitions, compliance regimes, and jurisdictional inconsistencies that slow institutional adoption to a crawl.

The Opportunity: Why Institutions Care

The offchain capital markets dwarf the onchain economy by several orders of magnitude. Trillions in bonds, equities, real estate, commodities, and alternative assets move through expensive, fragmented, and settlement-heavy processes every day. Moving even a small percentage of these markets onchain could unlock vast efficiencies.

But efficiency alone is not enough to move trillions of dollars. Institutional money requires legal clarity, predictable counterparty risk frameworks, and the ability to integrate with existing operational processes.

The Patchwork US Landscape

In the United States, regulatory oversight is fragmented. The SEC, CFTC, OCC, and state regulators often overlap or conflict. For tokenized assets, one common workaround has been private placements under Regulation D, which allow token offerings to qualified investors without full public registration.

While Reg D has enabled early experimentation, it is not scalable for global adoption. It limits participation to accredited investors and imposes resale restrictions, creating a siloed market.

This patchwork system forces tokenization projects to structure themselves around narrow exemptions, often sacrificing liquidity and interoperability in the process.

Beyond the US: Global Regulatory Momentum

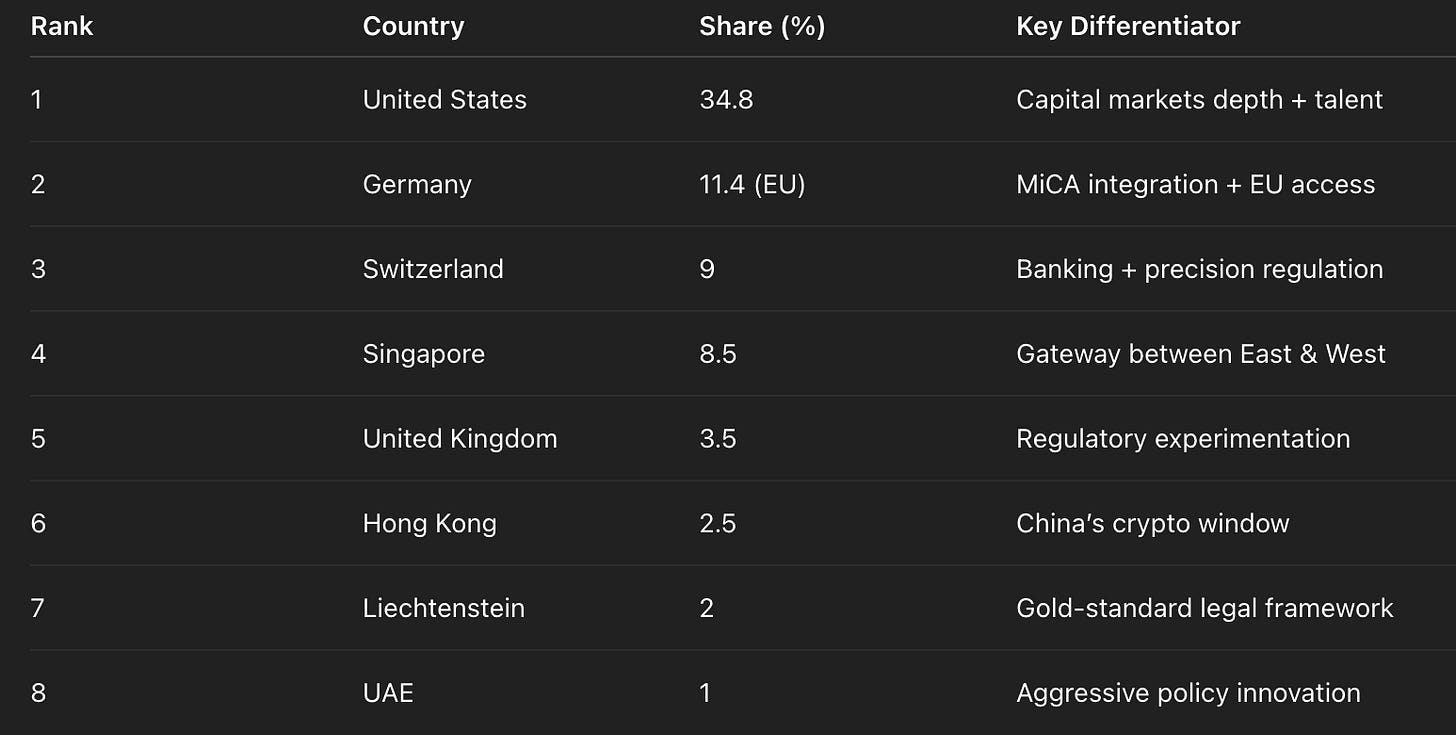

Outside the US, jurisdictions such as Switzerland, Singapore, and the UAE have been more proactive in crafting clear rules for tokenized securities and digital assets. The European Union’s MiCA framework, while imperfect, represents a coordinated attempt to unify rules across member states.

These environments give institutions the legal confidence to commit capital and infrastructure. That is why we see disproportionately higher tokenized bond issuances and asset-backed products emerging in these jurisdictions.

Why Regulation, Not Tech, Holds Back the Floodgates

Blockchain infrastructure today can process thousands of transactions per second, settle instantly, and operate at near-zero marginal cost. Stablecoins already handle billions in daily value transfer with negligible fees.

The bottleneck is no longer technological. The challenge is ensuring these systems meet the compliance, reporting, and governance standards required for large-scale institutional participation.

So, What Needs to Change?

For institutions to fully embrace onchain markets, we need:

Unified Legal Definitions – A clear and consistent framework for what constitutes a security, commodity, or payment token, recognized across jurisdictions.

Compliance by Design – Protocols must integrate KYC/KYB, transaction monitoring, and reporting as programmable features without sacrificing user privacy.

Interoperability Between Chains and Legacy Systems – Cross-chain messaging and integration with offchain settlement rails must be seamless.

Clear Custody and Bankruptcy Protections – Institutions need clarity on asset rights if an issuer, custodian, or protocol fails.

Global Coordination – Regulatory arbitrage will continue, but global standards will make it easier for compliant capital to flow without case-by-case restructuring.

The Path Forward

We are already seeing early signs of progress: tokenized treasuries crossing $1 billion in AUM, regulated exchanges listing tokenized bonds, and pilot projects with major custodians. But to move from pilot scale to systemic scale, the regulatory maze must be simplified.

Institutions are not allergic to innovation. They simply cannot operate in a world where the legal ground shifts under their feet. Clear, consistent rules will allow the ‘faster, cheaper, more secure’ promise of blockchain to finally meet the scale of global markets.

Cheers,

Ian

Ian Randle is a Core Contributor at www.derive.xyz and Founder of www.settledhere.com

This week’s article comes to you from the very beautiful Lake Garda in Italy!